If you’ve completed any education or training within the last financial year, you could claim the expenses as a tax deduction.

With the end of the financial year approaching, it’s important to know what you can and can’t claim on your tax return. The Australian Taxation Office (ATO) allows individuals to claim education expenses and course fees directly related to their employment. So, if you’re wanting to upgrade your skills or gain some new knowledge, there’s never been a better time.

You can only claim your education expenses and the cost of your course fees if the related study will:

- Maintain or improve the specific skills or knowledge required by your current role.

- Results in or is likely to result in an income increase from your current employer.

You can’t claim any deductions for courses that relate only in a general way to your current employment, or that help you to get a new job. For example, you can’t move from employment as a nurse to employment as a doctor.

Studies applicable for a tax deduction include:

- Short courses or workshops related to your current job or industry.

- Diplomas, Certificates, or University courses that enhance your skills or knowledge for your job.

- Industry conferences or seminars that relate to your work.

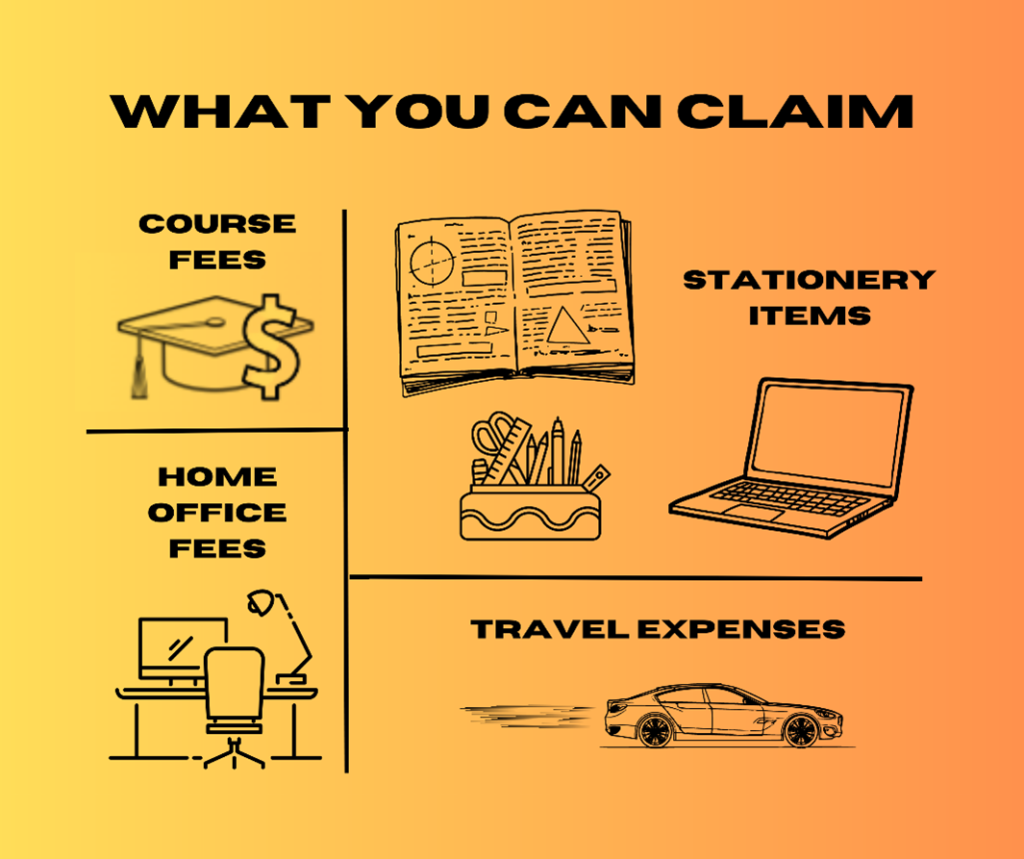

Multiple course-related expenses can be claimed; however, you can only claim a deduction for the portion of the expenses that are directly related to your study.

These expenses include:

- Course fees.

- Stationery items like computer consumables, textbooks, professional or academic journals, postage, and other regular stationery items.

- Home office fees like internet usage and phone calls. Although, this excludes any occupancy fees related to working from home.

- Car expenses for travel between your home and place of education, and between your place of work and place of education.

To claim a tax deduction for these expenses, you will need to keep accurate records and receipts of all costs incurred. You can use the myDeductions page of the ATO’s app to record your education expenses.

Depreciating assets like computers and printers can also be claimed as a deduction. However, they must be apportioned depending on the time used for private purposes, and the time used for education. For example, if a computer is used 50% of the time for study and 50% for private purposes, you can only claim half of the cost of the computer.

Education has a significant impact on your personal and professional development. With education expenses and course fees tax-deductible, there’s never been a better time to engage in study and take your career to the next level. Please note that we are not tax professionals, so we recommend you seek advice from a qualified taxation agent and visit the ATO’s website for further information.